Help

Out of network

When you go to a provider who is not in your network, you

may pay more for your care. You may also have to file your own claims.

Some plans do not provide any coverage for care received from

out-of-network providers, except under certain circumstances, including

but not limited to emergency and urgently needed services. Check your

coverage details or contact Humana for more information.

Your share

Your share is the amount you may owe your provider after your

plan benefits have been applied. Humana members with both Medicare and

Medicaid coverage may not be responsible for this amount and should

contact the provider for additional details.

Humana discounts

Humana has special rates with in-network providers that may

give you discounts on the amount you owe your provider. These are

savings to you and, are not included in the amount you pay.

Plan exclusion

A portion of your bill may be removed, or excluded, from the

total amount you owe. This is done based on the amount your provider is

allowed to charge for that benefit or service. Please check the reason

codes in your claim statement for more details.

Benefit exclusions

Benefit exclusions can be:

- Any billed services that are not covered by your plan

- Costs you may have to pay if you use an out-of-network provider

You will not be charged when an exclusion is due to

billing errors or missing information needed to complete a claim. Those

exclusions are the doctor’s responsibility and will not be added to the

amount you pay.

Please check the reason codes in your SmartSummary Explanation of Benefits (EOB) for more details.

Amount Humana paid

The amount your Humana plan pays toward your claim(s).

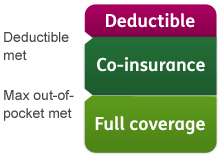

Maximum out-of-pocket

The most money you will be required to pay for covered

medical services and prescription drugs in a calendar year. This amount

includes copayments, deductibles and coinsurance.

Plan paid

The amount your plan paid toward your claim(s).

Part B

Medicare medical insurance helps pay for doctors' services, outpatient

hospital care, durable medical equipment and some medical services not

covered by Part A. This claim was processed under the Part B benefit.

Part D

This claim was processed under the Part D benefit. Part D covers

prescription drug coverages through Medicare-approved prescription drug

plans offered by private companies. Part D plans are available to anyone

eligible for Medicare benefits under Part A or enrolled in Part B.

DDW (Drug Discount Wrap)

This program assists Humana members when they need to buy drugs that are

not a covered benefit. This claim was processed as a DDW.

Centers for Medicare and Medicaid Services (CMS) excluded

This claim type covers medicines that are excluded by Medicare (CMS), but may or may not be covered under a plan benefit.

DMR (Direct Member Reimbursement)

DMR is used to reimburse Humana members. This occurs when a member paid

out of pocket in place of using their insurance. This claim processed

under DMR.

OTC (Over the Counter)

These are medicines sold directly to a consumer. They do not need a

prescription from a healthcare professional. This drug was processed as

an OTC drug.

PA (Prior Authorization)

There are certain drugs Humana must approve before your plan will cover

them. This claim was processed with a prior authorization number.